The how of digital and analytics in insurance study point focuses on how technology transforms the insurance industry. Digital tools like cloud computing and artificial intelligence help insurers analyze data more effectively. This leads to better risk assessment and personalized services for customers.

Analytics improves operations by automating processes, such as claims processing. Insurers can use predictive modeling to anticipate customer needs and identify fraud. Overall, these advancements enhance customer engagement and streamline workflows, making insurance more efficient and responsive to market demands.

Understanding the Role of Digital Technologies in Insurance

Digital technologies are reshaping the insurance industry. They enhance operations and improve customer experiences. Cloud computing allows for efficient data storage and access. This transformation helps insurers analyze vast amounts of data effectively.

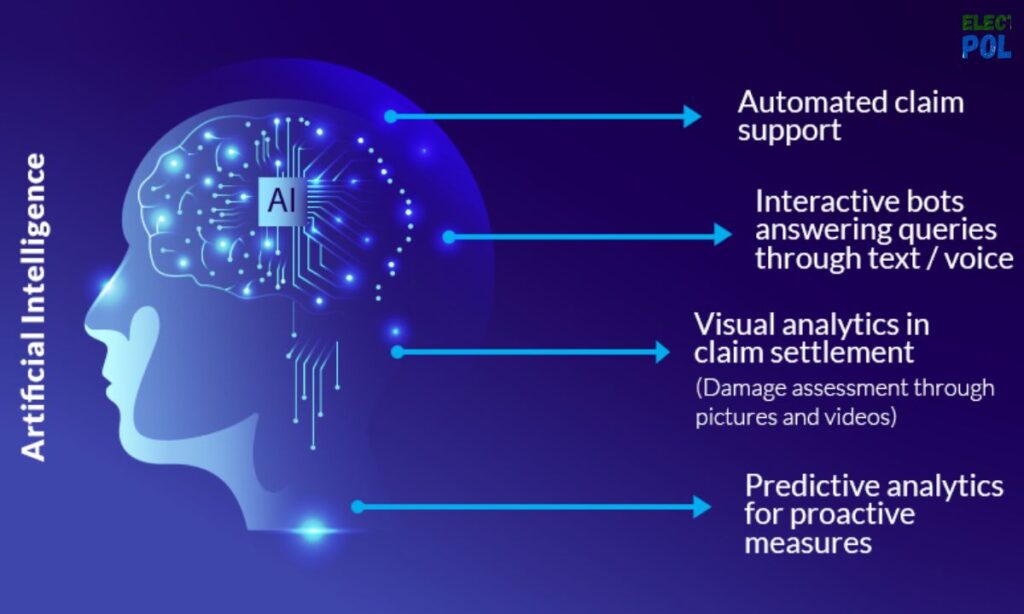

With artificial intelligence and machine learning, insurance companies can automate processes. This includes claims processing and risk assessment. These technologies enable more precise data-driven decisions. They also enhance customer engagement by personalizing services.

The Impact of Analytics on Insurance Operations

Insurance analytics plays a crucial role in decision-making. It helps companies evaluate risks more accurately. By using predictive modeling, insurers can anticipate future claims. This leads to better pricing strategies and improved financial stability.

Analytics also streamlines workflows. It automates routine tasks and identifies fraudulent claims. This reduces losses and increases efficiency. Overall, analytics profoundly enhances the operational capabilities of insurance providers.

The Integration of AI and Machine Learning in Insurance

The integration of AI and machine learning is vital for modern insurance practices. These technologies facilitate quick data analysis. They enhance the customer experience through tailored solutions. Insurers can deploy chatbots for instant customer service.

Additionally, AI-driven tools improve fraud detection. They analyze patterns in data to flag suspicious activities. This proactive approach ensures better security for both insurers and clients. Automation reduces the workload on human agents, allowing them to focus on complex cases.

The Role of Data in Shaping Insurance Products

Data is essential in developing innovative insurance products. Telematics offers insights into driving behaviors. This data enables usage-based insurance models. Customers pay premiums based on actual usage, fostering fairness.

In health insurance, wearables collect real-time data. This information allows for personalized premiums. Insurers can encourage healthier lifestyles through financial incentives. Such data-driven approaches lead to customer satisfaction and loyalty.

Read This Blog: What is Cybersecurity? Types, Threats and Cyber Safety Tips

The Challenges of Implementing Digital and Analytics in Insurance

Implementing digital technologies poses challenges. Data privacy concerns are paramount. Insurers must protect sensitive information against breaches. Compliance with regulations is crucial for maintaining customer trust.

Integrating new technologies with legacy systems can be complex. Many insurers still rely on outdated infrastructure. This can hinder the adoption of modern solutions. Additionally, the industry faces a talent gap in data science and analytics.

The Future of Digital and Analytics in Insurance

The future of the insurance industry lies in advanced technologies. Blockchain could revolutionize how transactions are recorded and verified. This ensures transparency and reduces fraud risks.

Moreover, the evolution of quantum computing may enhance data analysis capabilities. Insurers will be able to process complex datasets rapidly. This will lead to more accurate predictions and tailored products.

| Technology | Impact on Insurance |

|---|---|

| Cloud Computing | Efficient data storage |

| Artificial Intelligence | Enhanced customer engagement |

| Machine Learning | Improved risk assessment |

| Telematics | Usage-based insurance offerings |

| Blockchain | Increased transparency |

Frequently Asked Questions

What is digital transformation in insurance?

Digital transformation involves adopting new technologies to improve operations and customer experiences in the insurance sector.

How does analytics affect underwriting?

Analytics enables insurers to assess risks more accurately by evaluating diverse data points, leading to better pricing strategies.

What role does AI play in insurance?

AI automates processes, enhances customer service, and improves fraud detection in the insurance industry.

Why is data important in insurance?

Data shapes product development and enables personalized offerings that meet customer needs effectively.

What challenges do insurers face with digital adoption?

Insurers struggle with data privacy, integration with legacy systems, and finding skilled personnel.

Conclusion

The how of digital and analytics in insurance study point highlights the profound changes in the industry. Embracing digital transformation is crucial for staying competitive. By leveraging technologies like AI, machine learning, and analytics, insurers can offer personalized, efficient services.

Addressing challenges such as data privacy and integration will ensure a more secure future. The insurance industry is on the brink of a major transformation that promises enhanced customer satisfaction and operational efficiency.

I’m passionate electric scooter enthusiast and the voice behind this blog. I’m here to share my expertise and insights with you. From in-depth reviews to problem-solving guides, my goal is to help you make the most of your electric scooter experience.

![Gomyfinance.com Invest: I Made $5,000 in My First Month [Real Results 2025]](https://electopolo.com/wp-content/uploads/2025/05/Gomyfinance.com-Invest-I-Made-5000-in-My-First-Month-Real-Results-2025-150x150.jpg)