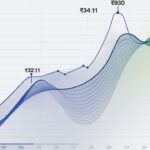

Integra Essentia has shown impressive growth in recent years, rising from ₹0.39 to ₹5.60. The share price target for 2024 is projected to be around ₹5.79, reflecting potential growth if the company expands its customer base and increases production capacity.

For 2025, analysts expect the price to continue rising, with targets around ₹6.50. By 2030, the target could reach approximately ₹7.89, depending on market conditions and the company’s performance.

Integra Essentia Company Overview

Integra Essentia is a small-cap company established in 2007, focusing on textiles. The company primarily manufactures garments and clothing accessories. Despite its humble beginnings, it has shown remarkable growth.

Over the past few years, Integra Essentia has transformed itself into a multibagger stock. With a market capitalization of ₹356 crore, it has attracted considerable attention from investors. Its strong financial performance highlights its potential in the competitive market.

Shareholding of LIC in Integra Essentia

The Life Insurance Corporation (LIC) holds a significant stake in Integra Essentia. As of Q1 FY2024, LIC owns 48,59,916 shares, which equates to a 1.06% ownership. This shareholding pattern reflects LIC’s confidence in the company.

LIC’s investment in Integra Essentia underscores its role in the stock market analysis of small-cap stocks. Such institutional support often signals strong future growth potential for investors.

Details of the Share Price

Integra Essentia’s share price has fluctuated in recent years. The stock rose from ₹0.39 to ₹5.60, reflecting a 1,350% return over three years. However, it has experienced some volatility in 2023.

Currently, the share price stands at ₹5.60, down from ₹6.85. This 20% decline raises questions about its future trajectory. Investors are keen to know if this is a temporary setback or a long-term trend.

Read This Blog: MRF Share Price Target 2024, 2025, up to 2030

Integra Essentia Share Price Target: 2025

The share price target for Integra Essentia in 2025 is projected to be around ₹5.79. This estimate considers the company’s growth potential and market conditions. Effective management could lead to significant sales growth.

Investors should monitor the company’s performance closely. If Integra Essentia expands its customer base and increases manufacturing capacity, the stock could see positive growth.

Stock Performance

Integra Essentia has shown impressive stock performance over the past few years. Despite recent declines, its long-term trajectory remains promising. The company’s ability to adapt to market changes is crucial for future success.

Investors should assess the investment risk associated with small-cap stocks. High volatility is common, but the potential for high returns can be appealing. A balanced approach is essential for maximizing returns.

Read this Blog: Hindustan Copper Share Price Target 2025 2026 2027 to 2030

Is It The Right Time To Buy This Company’s Share?

Determining the right time to invest in Integra Essentia requires careful analysis. The stock’s current price presents an opportunity for potential buyers. However, consideration of market trends and economic indicators is essential.

Investors should evaluate their investment strategies before making a move. The potential for significant capital gains exists, but so does the risk associated with small-cap stocks.

Frequently Asked Questions

What is the share price target for Integra Essentia in 2024?

The target for 2024 is yet to be finalized, but market conditions will play a crucial role.

How much does LIC own in Integra Essentia?

LIC holds 1.06% of Integra Essentia, equating to 48,59,916 shares as of Q1 FY2024.

Has Integra Essentia’s stock been volatile?

Yes, the stock has experienced fluctuations, especially in 2023, with a notable decline.

Is Integra Essentia a good investment?

It could be, depending on your risk tolerance and market analysis. Assess carefully.

What factors influence Integra Essentia’s share price?

Factors include market trends, financial performance, and investor sentiment, among others.

Conclusion

In summary, Integra Essentia represents an intriguing opportunity in the penny stocks sector. With its impressive return on investment (ROI) over the past three years, the company’s future targets are promising. However, investors must navigate the inherent stock volatility and conduct thorough equity research.

Staying informed about market trends and adopting a sound investment strategy will be vital for success. As the company continues to evolve, monitoring its performance will be key to making informed investment decisions.

I’m passionate electric scooter enthusiast and the voice behind this blog. I’m here to share my expertise and insights with you. From in-depth reviews to problem-solving guides, my goal is to help you make the most of your electric scooter experience.

![Gomyfinance.com Invest: I Made $5,000 in My First Month [Real Results 2025]](https://electopolo.com/wp-content/uploads/2025/05/Gomyfinance.com-Invest-I-Made-5000-in-My-First-Month-Real-Results-2025-150x150.jpg)